- Get link

- X

- Other Apps

Please Note: Blog posts are not selected, edited or screened by Seeking Alpha editors.

Contributor Since 2014

Microvision shareholder that knows that Microvision lidar is the best

Summary

- MicroVison is technically the current market leader, having solved technical problems that none of the lidar vendors had solved before.

- MicroVision is superior in resolution, form factor, interferences with other lidar systems.

- MicroVision market capitalization is only 1/3 that of Luminar, even though MicroVision products are technically superior.

- This absurd stock market situation can lead to a short squeeze in the short term. At the latest, when large car manufacturers will decide in favor of MicroVision.

- It is therefore very risky to sell MicroVision shares short.

This article describes why in new markets it is wrong to look only at key figures such as sales in previous years or at the sheer number of partners. Instead, you need to find out which company has the best technology and therefore the best market prospects. It compares the products of the challenger MicroVision (NASDAQ:MVIS) with the products of the current (by market capitalization) market leader Luminar (LAZR) to show that challengers sometimes have better products and can overtake existing companies. At the same time, it shows that short sellers put themselves in great danger of selling short technically superior companies, because (in this case) car manufacturers buy products based on their technical data and not on the valuation of companies by the stock market.

Unfortunately, hardly any articles that the author knows of, be they articles on "professional" websites or blogs, go into the technology and product details as well as manufacturing costs for products of the companies about whose shares a buy or sell recommendation is made. Nor on what this means for future sales, market and company prospects.

This is not surprising, many investors are no longer interested in companies and their products at all, only in (minimal) daily profits, especially the short sellers who "argue" with "arguments" like "what a scam", "what a sh.. " and the like "argue" without ever substantiating this classification. Main thing to create a (negative) mood to get others to sell. Same in the opposite direction. There is daily speculation about takeovers or attempts to bring about a short squeeze based on certain percentages that a stock is sold short.

Both are wrong in the first place.

Hardly any investors still invest in products and companies, many are only "gamblers". At the same time, these players put products, companies and jobs at risk. For example, a good product cannot be developed and sold overnight. Nevertheless, these gamblers expect results in days or weeks and months at the most, and if they don't come immediately, this is made out to be a problem. Even though everything within the company is on schedule. Even the development of an iPhone takes a year or more. More and more often you can read, especially with new products or companies, that the company has not made any sales or profits yet. How could it, if the product is still in development?

If that still doesn't work, the killer argument will eventually be used. Competitor XYZ is already on the market and sells more. Or already has many partners. This was also the argument regarding Apple when Nokia was still the world market leader for mobile phones and smartphones and Apple presented the first iPhone. The outcome is well known. Or with Tesla vis-à-vis the established car manufacturers. Today, a Tesla drives away even a Porsche and Tesla is constantly building new factories. Porsche, on the other hand, is also doing well, but cannot keep up with Tesla's expansion and is technically (e.g. in terms of range) lagging behind.

What all of this has in common is that you can't extrapolate from the past to the future. Otherwise, there would never be new market leaders. The future of a company lies in its current and future- oriented products, not in its old ones. There are, of course, exceptions to the rule, such as food manufacturers, like Coca-Cola, or banks, etc. Here, however, it should be about technical products and their manufacturers.

Summary: Ultimately, only the business outlook determines the future of a company and thus the share price. The business outlook depends on the current and future products.

That is why short sales figures etc. are not considered here. Instead, it will be shown why there is currently only one company in the field of lidar sensors that meets all the requirements of large car manufacturers such as Volkswagen, Toyota, etc. and where a short squeeze could be triggered shortly due to their technical superiority, since this technological superiority cannot be explained away or "sold short".

It should likely cause price reactions when a company is valued at only about 1/3 the market cap of inferior competitors on the stock market, as MicroVision currently is relative to Luminar.

Both companies in September 2021 at the world's largest motor show IAA in Munich:

Sources: private

Because in the field of lidar for self-driving cars (levels 3-5), the current "official" market leader is Luminar. "Market leader" mainly because of the market capitalization and the hype around the young company founder and CEO. Luminar has not sold any finished products yet. Last year, Luminar only sold about 100 development systems. I am not aware of numbers for 2021.

There is no car in the world that could be purchased with a Luminar lidar. This is already due to the fact that the company does not yet have a deliverable product.

However, if the market leader has not yet managed to launch and sell a product for self-driving cars, it is not surprising that its competitors have not yet been able to generate sales in this area either.

Is lidar necessary?

It should not be discussed further that Mr. Musk as CEO of the company Tesla considered lidar systems superfluous. First of all, this statement is already more than two years old (from mid-2019) and was quite correct at that time. when lidar systems were far too expensive (up to $100,000), far too big so they had to be mounted on car roofs and their resolution was simply too poor compared to cameras. But development continues and today the situation is very different.

For his part, an IBM CEO had also estimated the worldwide demand for computers at only about five(!) units. This shows that even CEOs of global corporations can be wrong.

The series of accidents with Tesla cars show that cameras alone are probably not able to guarantee a safe control of a car.

In addition, there are far larger car companies that see lidar as indispensable.

Market for Lidar Systems

So, it should be undeniable that there is a market for lidar systems. With about 70 million cars produced per year plus trucks etc., there will soon be an annual demand of 50-300 million units (usually several modules are needed per car, just as a Tesla has many cameras; at least one device each for the view to the front and one for the view to the rear), even if you exclude the Tesla cars.

Technology

After the introduction to the topic, we will now look at the technology and why it cannot be that a technologically highly superior company is only valued at a company value of only 1/3 of the technically far inferior "market leader" and thus a short squeeze should only be a matter of time, since the true valuation very probably cannot be prevented for a long time.

This should occur at the latest when the first orders come in or when just enough investors realize that something seems to be fundamentally wrong here. Depending on what happens first. Both can happen on a daily basis.

Upcoming orders can be considered almost certain due to the superior technology and the much earlier availability of the MicroVision models.

Car manufacturers are not interested in TV appearances by CEOs or fairytale up-and-coming stories; they want to build the best cars in their segment and for their target group.

General requirements of car manufacturers for car models

All car manufacturers in all target groups have the following essential requirements:

Security

Design

Vehicle characteristics (such as maximum speed, turning circle, etc.)

Price

Depending on the target group of a car model, these are of course weighted differently, so that no order can be given. Only safety should always be at the top of the list for all manufacturers.

Of course, a Mercedes has to look better or different than a pick-up. But it doesn't have to be as maneuverable and its load area can be smaller. However, it is no longer possible to sell ugly pick-ups today. While roof superstructures may not bother pick-ups, they are probably not acceptable for a Mercedes, Volkswagen or Toyota.

In terms of lidar systems, this means:

Security:

Highest possible resolution

Refresh rate must be high enough for short response times

non-dazzle

Design: as invisible as possible

Price: must match the selling price of the vehicle

System comparison

So, let's compare the (only) system from the (previous) market leader Luminar with those from MicroVision (four models in total).

First of all, it is noticeable that Luminar intends to sell only one model with the product "Iris", while MicroVision intends to offer three other models in addition to the top model and to cover other market segments with lower or specialized requirements.

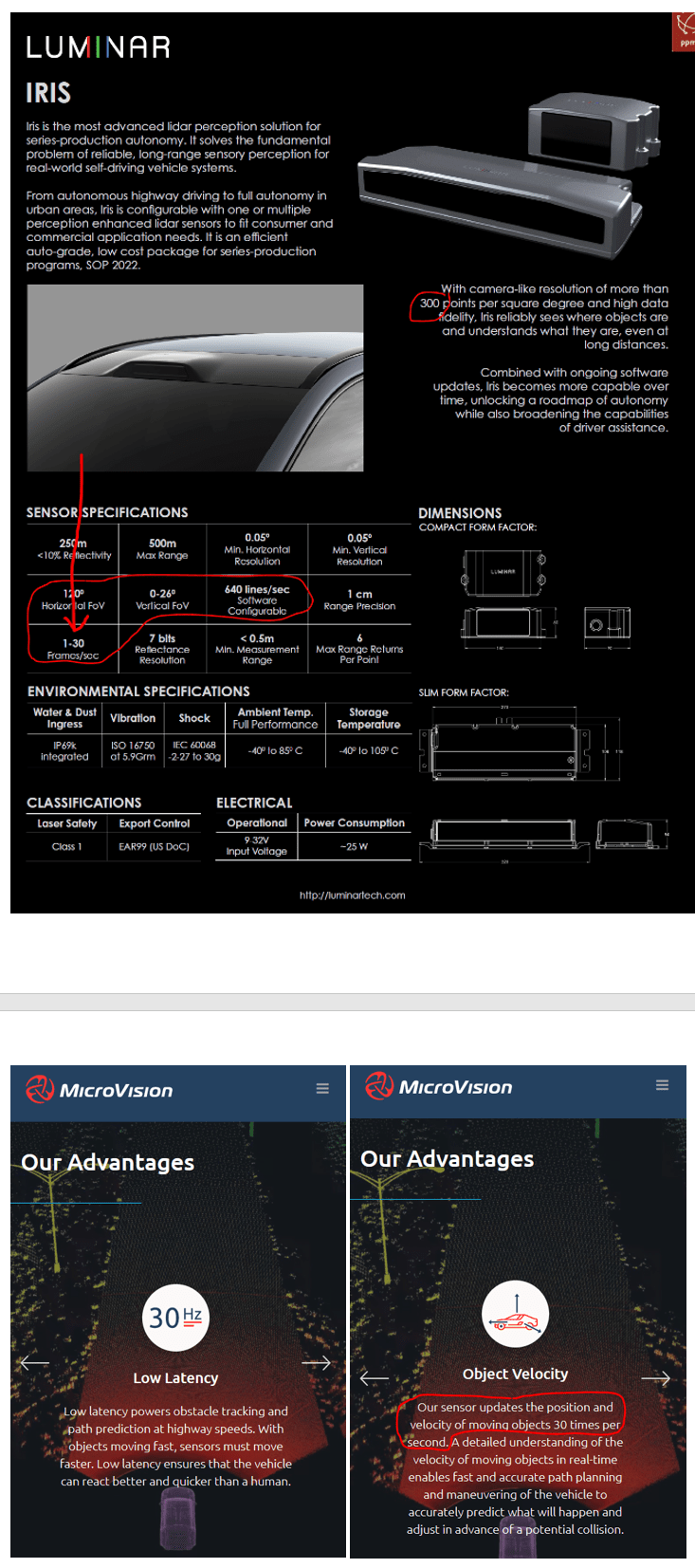

Luminar Iris and MicroVision Lidar models:

Source: Luminar and MicroVision Press Kit

Security: Resolution

This is quite simple to understand. As is also known for cameras, a camera or a lidar system sees more details and thus smaller objects, the higher the resolution. If the resolution is lower than that of the competition, a lidar system is generally considered to be less reliable, as it may detect a tree, but not a stone on the road. However, both can be dangerous.

Only the resolutions measured by the companies themselves and officially published shall be considered.

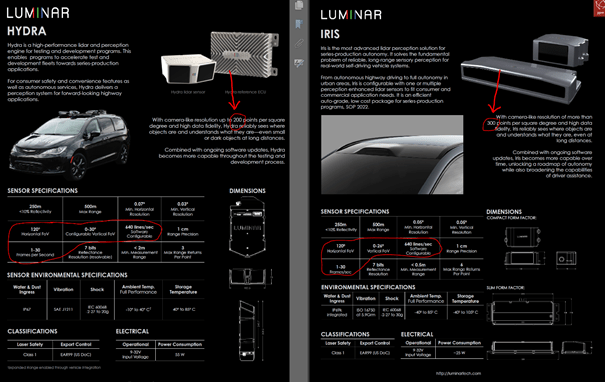

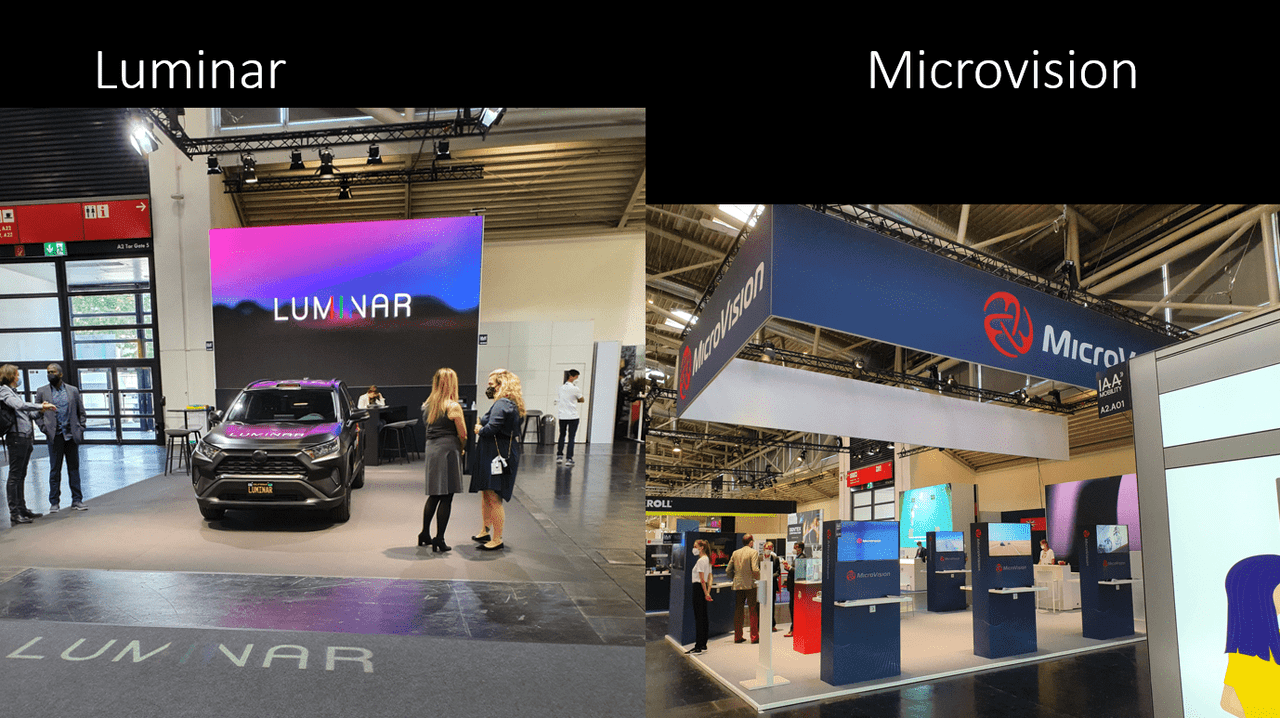

The company Luminar has measured a resolution of 600,000 points per second for their model "Hydra":

Measurement Rate per Pixel 600,000 pt/s

Source: Luminar presentation from 2020

The future successor model intended for sale is to have a 50% increase in resolution, i.e. approximately 900,000 points per second. The 50% increase is due to the fact that the resolution in dots per square degree is to increase from 200 to 300 and the other parameters are to remain essentially unchanged:

Source: Luminar data sheets for the Hydra and Iris models

In contrast, MicroVision measured a resolution of over 10 million points per second. That is twelve times the resolution that Luminar offers. This means that a MicroVision Lidar system can also detect twelve times more details.

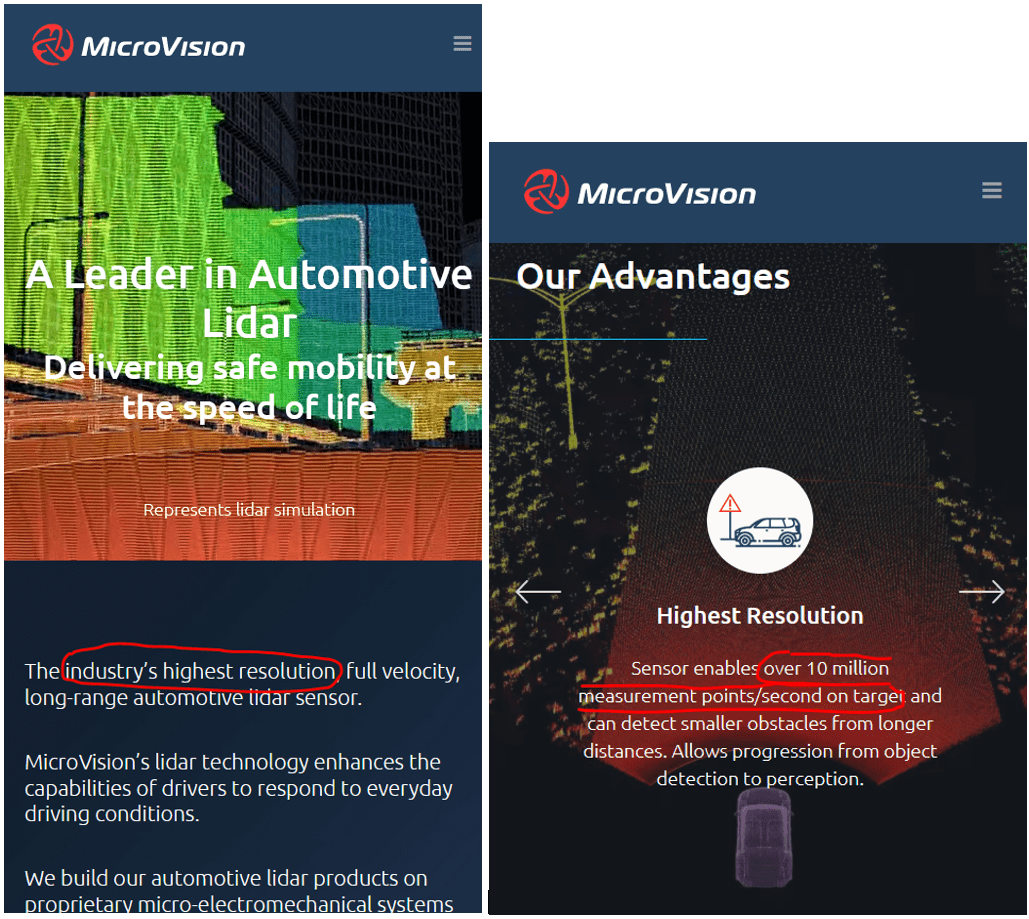

Accordingly, MicroVision also writes on its website of

The industry's highest resolution, full velocity, long-range automotive lidar sensor.

Source: MicroVision October 2021

As well as from

Highest Resolution

Sensor enables over10 million measurement points/second on target and can detect smaller obstacles from longer distances. Allows progression from object detection to perception.

Source: MicroVision October 2021

These details have been there for months and were not changed after the world's largest auto show, the IAA in Munich in September 2021, where all the big-name rivals were also exhibiting.

Nor does any other competitor appear to claim the "highest resolution". As far as we know, no MicroVision competitor has complained to the SEC about misrepresentation, so even the competition, including Luminar, seems to accept that MicroVision Lidar has the highest resolution for lidar systems for self-driving cars.

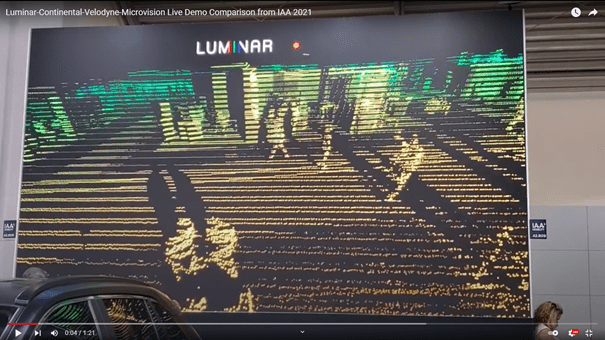

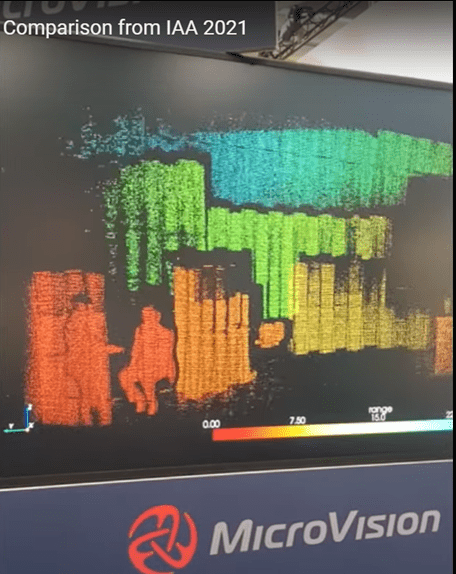

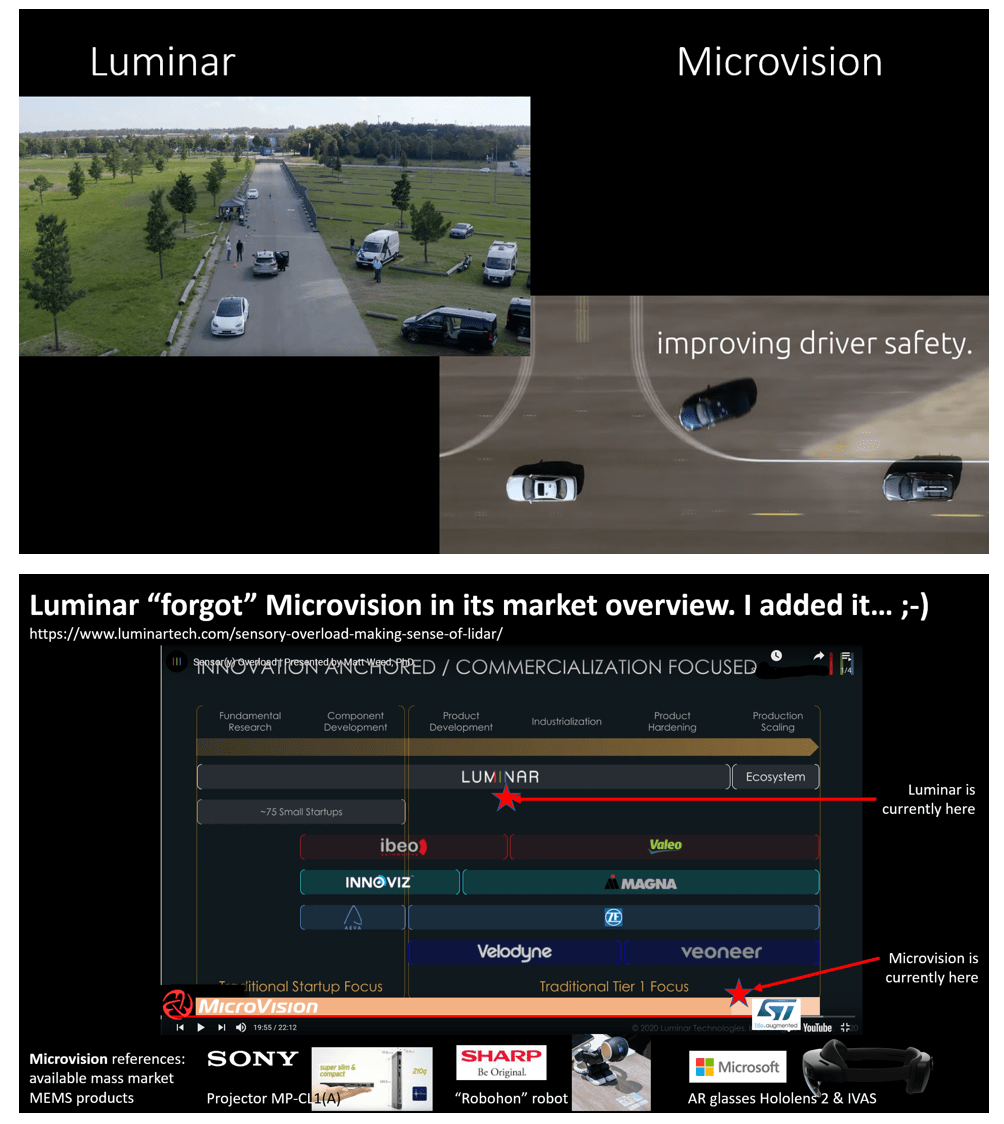

The differences in resolution were particularly visible at the IAA in Munich this September. Both Luminar and MicroVision filmed the visitors on or in front of their booths. The environmental conditions were therefore almost identical.

Luminar Iris Resolution:

Source: youtube

It is clearly visible that Luminar only shows single lines, while MicroVision shows closed objects. No wonder with a twelvefold higher resolution.

This makes the score 1-0 in favor of MicroVision over Luminar.

This in the already most important category, because as already mentioned, the resolution is the most important to recognize as many details as possible, i.e. objects on and beside the road, which could be a danger for the car or others (e.g. small children or animals should not be run over).

Safety: refresh rate

The frame rate (HZ) is also very important. It indicates how many images a camera or lidar system delivers per second.

For example, if only one image per second is created, a car at a speed of 100 km/h has already covered a distance of 27.78 meters in that time. This corresponds to the length of about six cars. At a frame rate of 30, on the other hand, the car has covered less than one meter per frame. Thus, at 30 Hz, a passenger car has 30 times more decision-making power and (TIME) to react to something and can do so 30 times faster.

Luminar and MicroVision lidar systems each have up to 30 Hz.

On closer inspection, however, it is noticeable that MicroVision systems always seem to have 30 Hz, Luminar Lidar lies in the range of 1-30 Hz. This suggests that with higher frame rates at Luminar Iris the resolution decreases while it remains the same at MicroVision, so there are 30 images with the high resolution.

Source: Luminar Iris data sheet and MicroVision October 2021

MicroVision thus seems to be significantly better here as well. However, since the details are not known what exactly 1-30 Hz means for Luminar, this category is not evaluated conclusively.

Safety: non-blinding

Everyone knows it: If you look into the sun without sunglasses, you will be blinded and see less or almost nothing. The same applies to cameras, but also lidar systems. Here, glare protection is necessary. For people, sunglasses. With cameras and especially lidar systems it is technically much more complex.

For lidar systems there is even not only one sun, but several. If there are several cars on a road within sight of a lidar system, which also have lidar systems, these lidar systems can dazzle each other. This will almost always occur in the future if many cars are equipped with lidar systems.

In discussions about lidar companies, this problem gets little attention as far as the author knows.

This is one of the main problems that lidar companies have to solve. Without a complete solution, a lidar system can hardly be used in a meaningful way, since it can be blinded and consequently temporarily be completely or partially blind - while the car continues to drive.

This is because lidar systems themselves emit light in the form of laser pulses and wait to see whether it is reflected. If it is reflected, it will eventually return to the lidar system. The distance of the reflected object can then be determined from the duration, since the speed of light is both known and constant.

Lidar systems thus illuminate the environment in areas of light that are invisible to humans.

Consequence: A lidar system may be dazzled from all sides, as if many laser pointers were directed at the lidar system. So not only the own light comes back, but also foreign light.

A lidar system must therefore ignore all extraneous light and filter out its own on the amount of light. It must not measure extraneous light under any circumstances.

This is a technically highly complex and difficult problem to solve.

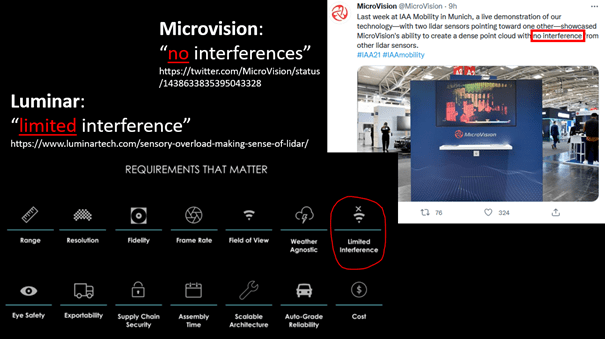

As far as the author knows, only MicroVision has solved this problem completely.

The company Luminar has recognized the problem after all and names it also officially, has however according to own representation on the Internet side no complete solution for it. But only a partial solution whereby this is not defined more precisely:

limited interference

Sources: Luminar and MicroVision.

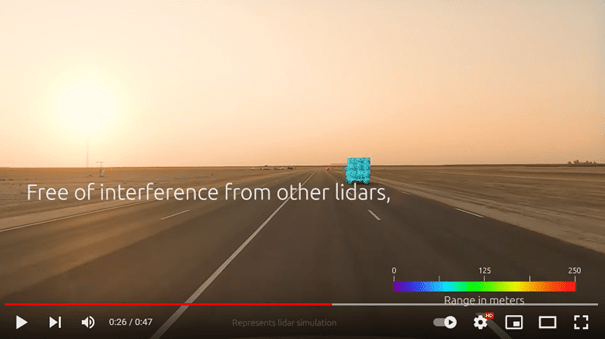

However, MicroVision clearly states that the lidar systems are completely immune to light from other lidar systems and the sun as show below from the MicroVision October 2021.

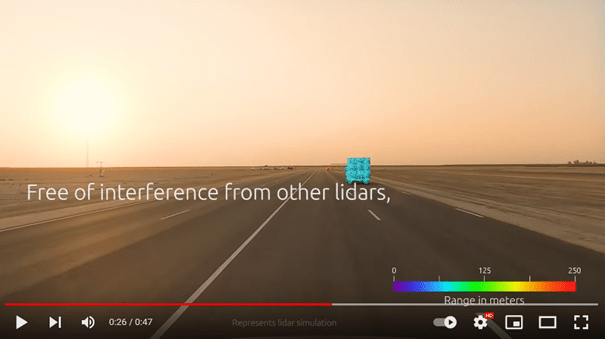

Video content from the youtube video "Interference Immunity": MicroVision's description to the video states complete immunity to other lidar systems ("free"):

MicroVision's Interference Immunity video released at IAA 2021. MicroVision's lidar sensor will work across all ambient lighting and is free of interference from other lidars.

Source: youtube

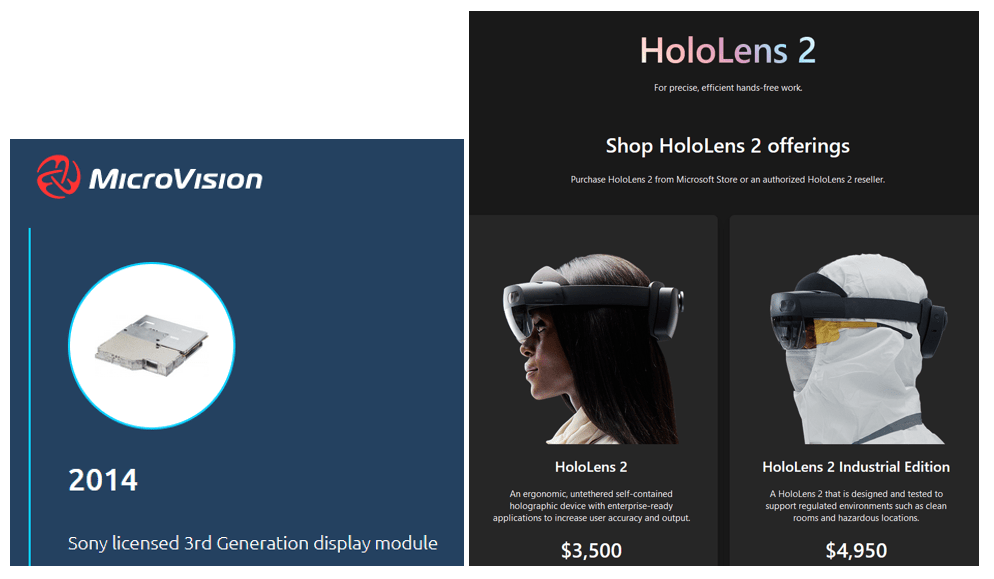

According to MicroVision, it has adopted a solution that MicroVision has already developed for the HoloLens 2 from Microsoft and which is also used there. This is probably also patented.

A lidar system like Luminar's, which is only partially immune to other lidar systems and sunlight, is simply too dangerous and can be blinded or even provide false information, endangering lives.

This point goes clearly to MicroVision. The score is therefore 2:0.

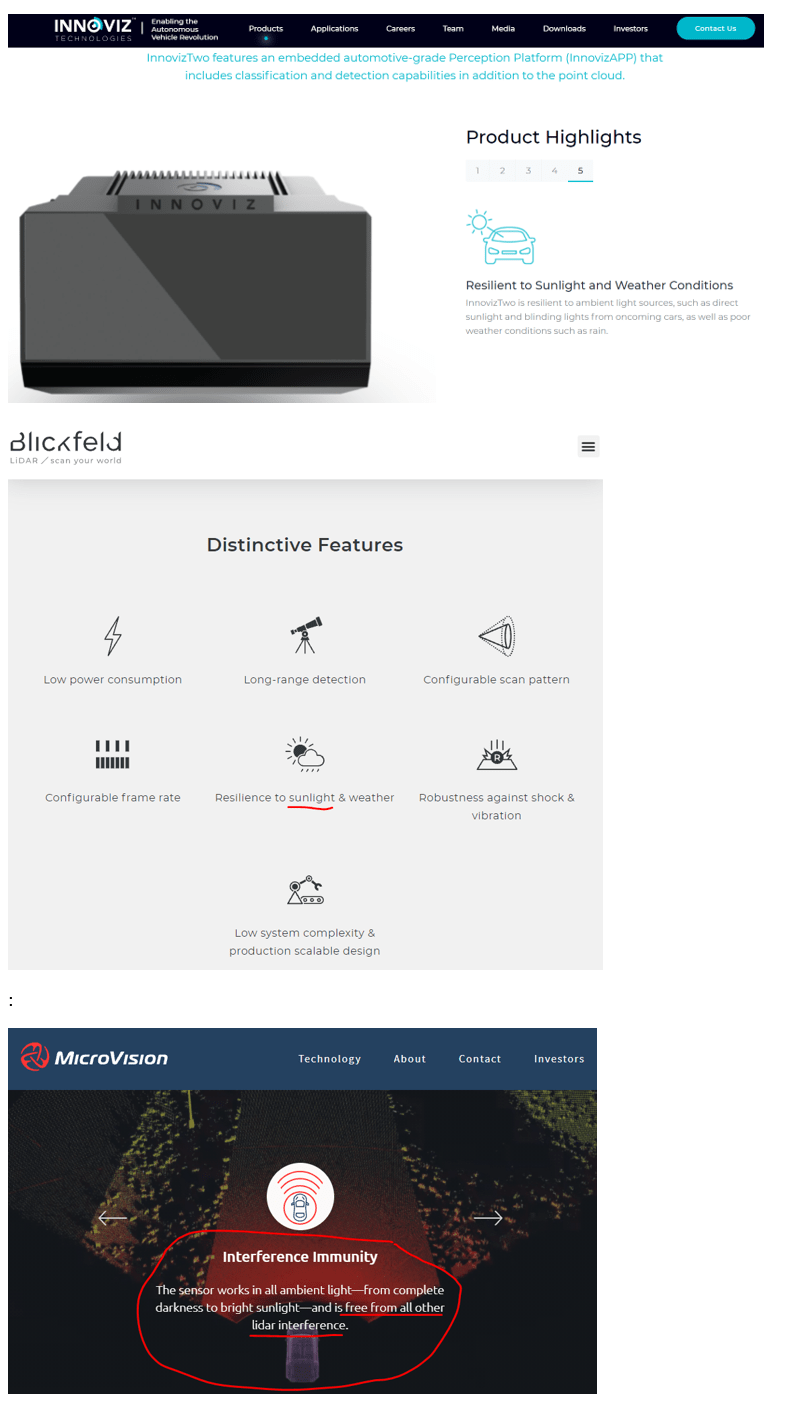

Other competitors also don't seem to have solved this hugely important problem yet. Innoviz has only considered sunlight even with InnovizTwo. Also Blickfeld has not solved the problem, but only for sunlight. This seems to apply to all competitors This would make MicroVision the only company whose lidar systems are completely immune to light from other lidar systems. For comparison:

Source: InnovizTwo (NASDAQ:INVZ) and Blickfeld Vision Plus and MicroVision

Practicability

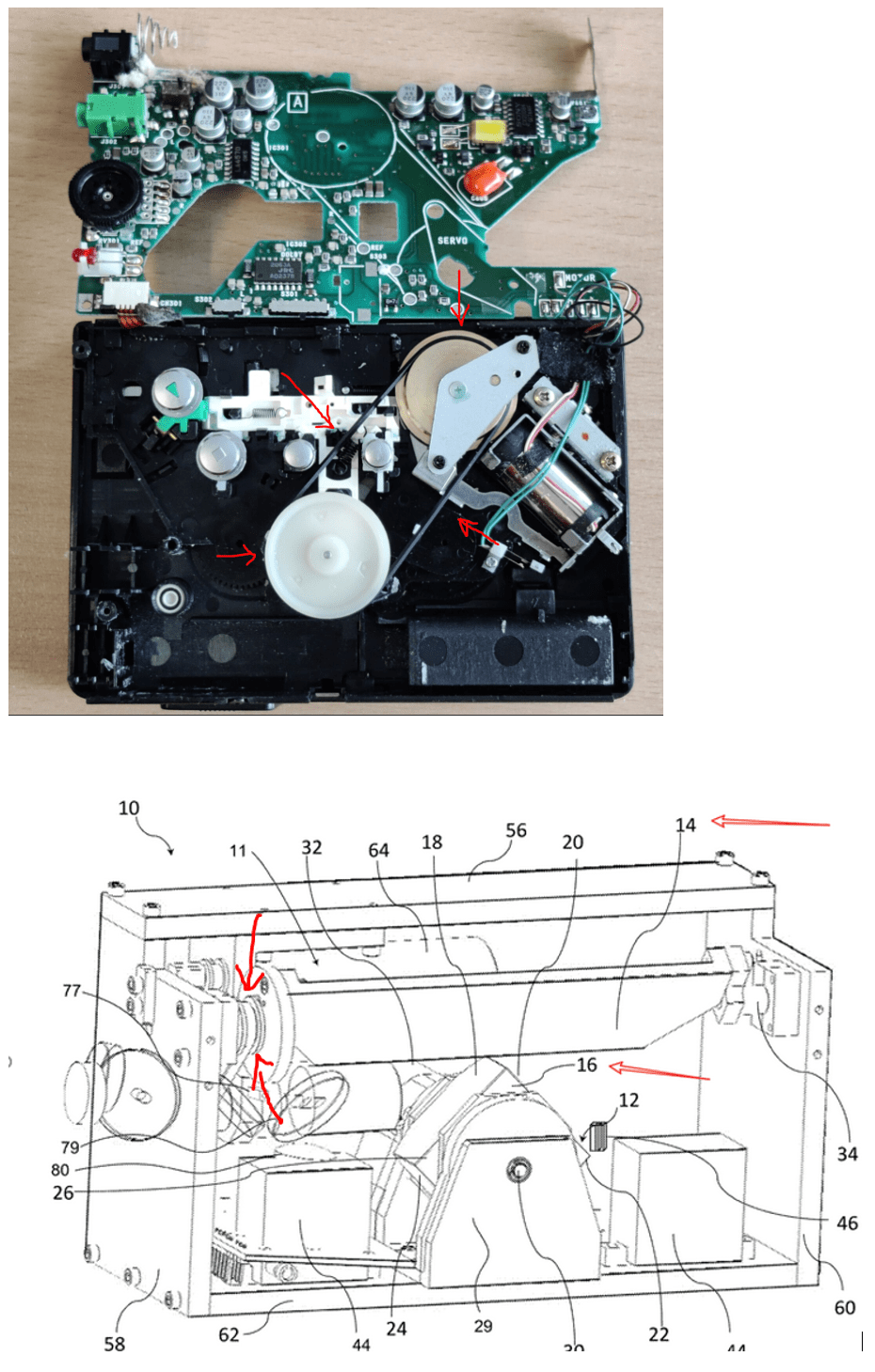

The author still knows the Walkman from Sony. For the younger ones: These were cassette recorders that could play music that was recorded on magnetic tapes. This tape had to be moved and that was done by a belt drive. The belt drive (and not a direct drive) was used to soften vibrations. This technology from the 80s of the last century is used by Luminar as a drive in Luminar Iris as shown in a patent drawing below (top picture is the inside of a Sony Walkman):

Source: Walkman and Luminar patent drawing.

The reason is simple: Luminar, like Sony back then, also wants to avoid vibrations being transmitted to the shaft.

However, the author doubts that the Luminar Lidar system Iris will survive everyday car use for years without repairs. Belts wear out, become brittle and even the slightest changes in length etc. will render the systems unusable and result in high repair costs for the car owner.

The other moving parts such as shafts will also wear out. The slightest changes will also render the system unusable, since a laser beam has to be controlled, which requires the highest precision. With Sony Walkman, the music didn't sound as good then. With Luminar, the system will fail immediately. After all,cars have a lifespan of ten to twenty years.

Almost all of Luminar's competitors do not have this problem. Since they, including MicroVision, do not use any moving parts in their systems, at least in the new models. MicroVision has chosen the right architecture with Solid State, which has long proven its suitability for everyday use in the Microsoft HoloLens 2 and the further development IVAS for the US Army, even under the most difficult conditions that regularly occur in the military.

Design

However, a safe car is of no use if no one buys it.

Since design is very important in all areas of life, from smartphones to cars, and is at least one of the deciding factors in a purchase decision, if not the deciding factor, no car manufacturer can afford to install ugly lidar systems, such as those used to be installed on the roof or as attachments in the front, etc.

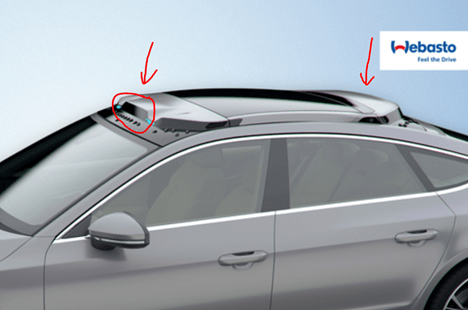

While MicroVision plans to install its lidar system where the interior rearview mirror is located, Luminar wants to install the Iris model on the roof in a bulge in the roof.

Suggestions from Luminar for the installation of "Iris":

Source: Luminar and Luminar Press

Installation suggestion from MicroVision:

Source: Microvisionyoutube video

This is where the mechanical-optical internal design of Luminar Iris takes its toll, resulting in a lidar system that is many times larger than MicroVision's chip-based lidar system, which has no mechanical parts.

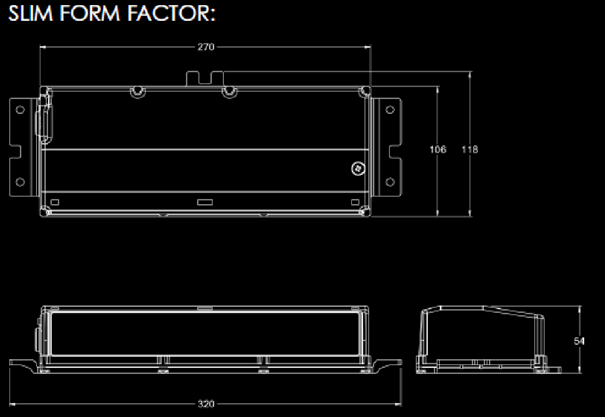

The dimensions of Luminar Iris are according to the official Luminar data sheet:

Source: Luminar Iris data sheet

Thus, Luminar Iris without holders has a volume of: 27 cm * 5,4 cm * 10,6 cm = 1.545,48 ccm

The A-sample from MicroVision has a size of approx.

20 cm * 11 cm * 3,4 cm = 748 ccm

It should be noted that the data from Luminar are the final dimensions, while MicroVision has only measured a prototype, the size of which could be halved in the final product to about 350 ccm, as MicroVision told visitors at the IAA.

The MicroVision Lidar has therefore already as prototype only half the volume and like Luminar Iris and final, optimized product probably less than 1/5 of the size of Luminar Iris.

Source: reddit and MicroVision

Very important for car manufacturers to know: While Luminar Iris is wide and tall, the MicroVision Lidar system is narrow and flat.

Only this design allows the seamless integration into car designs.

From this author's point of view, the size and shape of MicroVision's lidar system is a knockout criterion for all car manufacturers who don't want to disfigure their car design.

In addition, self-driving cars require at least two lidar systems, one for the view to the front and one for the view to the rear. The roof would therefore have to be bulged out at the front and rear to accommodate the Luminar lidar systems.

MicroVision lidar is both very thin and very narrow, while Luminar lidar is relatively thick and very wide. Car designers needed thin and narrow lidar systems.

This point also goes clearly to MicroVision, so the score is already 3:0.

Price

Development costs

By its nature, a price of a component strongly depends on the number of pieces. This is because a price is made up of several components. They are the fixed costs, the cost of materials and manufacturing costs (and service, recycling costs etc.)

The fixed costs are, for example, the costs of development but also the other general costs that a company has and that are attributable to the product. They become lower per unit the higher the number of units. Development costs of 1 million dollars mean that products sold in quantity 1 must cost at least 1 million dollars. However, if the product is sold in a million units, the price of a unit is only at least $1.

Development costs incurred:

Luminar: All expenses in the last ten years, as the company has only developed one product so far: Accumulated deficit: $697,254,000 (Source: Luminar Q2 2021 Results)

MicroVision: Operating costs for approximately two years, as development did not begin until early 2020 and company previously developed and sold other products (such as a projector for Sony, Sharp, Ragenthek; interactive projector, consumer lidar, projectors for HoloLens 2). Here, we can assume roughly $50 million, as MicroVision's operating costs are about $25 million per year (Source: Q2 2021).

This makes the development costs to be allocated to the final prices about $800 million for Luminar by the start of production in late 2022 and only about $50 million for MicroVision.

This means that the development costs for Luminar's lidar systems are approximately 16 times those for MicroVision. Of course, this has to be taken into account in the pricing.

Production costs

However, the development costs do not yet constitute a product. The material costs in particular must be taken into account here. As a rule of thumb: The more expensive a material is and the more material is needed, the more expensive a product will be. A watch made of gold is more expensive than one made of steel. In the same way, a car is more expensive than a bicycle because it requires much more material (and for other reasons).

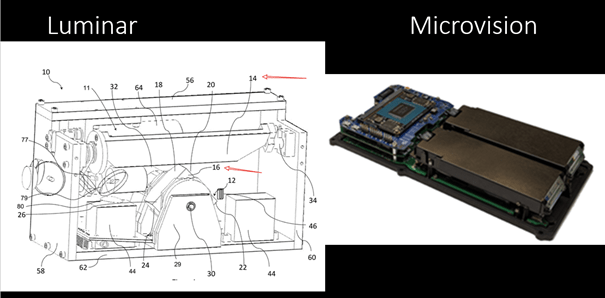

Both the amount of material needed and the manufacturing costs should be much lower for MicroVision. While the Luminar Lidar consists of solid aluminum blocks, MicroVision probably only needs a plastic housing.

In addition, Luminar has many mechanical components, whereas MicroVision uses a chip-sized MEMS module and does not use any mechanical components and therefore does not have to manufacture any mechanical components:

Sources: Luminar patent application and MicroVision

It is interesting that Luminar never shows the internal structure of Iris. Luminar always shows only empty cases.

MicroVision, on the other hand, can use inexpensive plastic because MicroVision does not use moving parts.

The mechanical components in the Luminar Lidar are not likely to be cheap to produce either, but they are much cheaper than the production of the many mechanical components, as Luminar requires many machines such as lathes and milling machines for this, on which they have to be turned and milled to extremely low tolerances, for example.

Source: Luminar Q1 Update and Q2

Please watch these videos, how complex the production of the Luminar Lidar is, while MicroVision (see photo above) only has to assemble printed circuit boards, connect them and insert them into a housing. These differences are the reason why Luminar Lidar- System will never be able to produce as cheap as MicroVision:

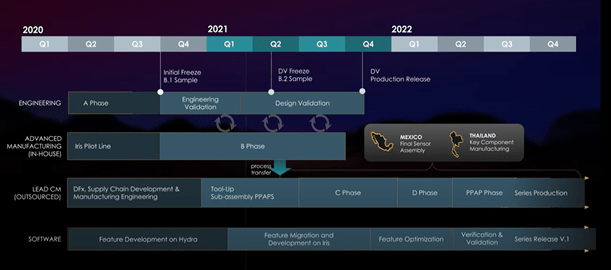

That's also why it takes Luminar two years just to set up production, while MicroVision has developed a completely new system and can produce it in that time. Above is also Luminar's schedule (from The Path to Series Production: Q1 Update - YouTube).

Costs increase in manufacturing the lower the tolerances have to be. The lower the tolerances that have to be maintained during production, the more expensive they are. The costs do not increase linearly, but rather exponentially.

It goes without saying that only very low tolerances can be permitted here for the control of a laser beam, which certainly go to the limits of what is feasible.

This means that the manufacturing costs are certainly many times higher than those of MicroVision due

to the high-precision machines

very precise tools required

Luminar lidar consists of many more individual parts and

significantly higher costs for quality assurance and testing.

Luminar ends up doing what MicroVision does on a chip basis (MEMS), controlling a laser beam, the old-fashioned way via mechanical components like shafts and a belt drive. See patent drawing before.

The result is not only a much larger device, much poorer resolution due to the limitations of the Luminar concept (e.g. moving masses, inertia, etc.) but also much higher cost to manufacture simply due to the large number of components.

Luminar thus undoubtedly needs significantly more material, more machinery and more personnel to produce a lidar system, since more steps are required due to the large number of mechanical parts anda high degree of automation does not seem possible.

The MicroVision Lidar can be assembled on almost any (automated) assembly line for smartphones or computers, since it consists of nothing more than a housing, computer chips and circuit boards, just like any smartphone, notebook or computer.

It can therefore be assumed that Luminar Iris is significantly more expensive to manufacture than MicroVision Lidar.

Scalability

Since MicroVision apparently does not have any moving mechanical parts to finish and therefore does not need any special machines, but will be able to use virtually any production line for smartphones or computers, there are not only the correspondingly high costs for their own factories as Luminar needs them and is also currently creating, but the scalability and thus the deliverability is significantly higher.

Smartphones are now manufactured in quantities of hundreds of millions per year. Computers in similar orders of magnitude. Consequently, it should not be difficult for MicroVision to produce almost any number of units required if a mass producer such as Foxconn is commissioned.

Development status

While Luminar is still testing the stopping in front of a dummy on a short test section at low speed according to the last published videos, MicroVision has already a company specialized in such tests with its own employees to test on a company-owned test track at high speeds. The following presentation of Luminar shows the current progress:

Sources: Luminar and MicroVision

Customers and partners

A distinction must be made between customers (= companies that actually buy larger quantities of the products) and partners (= companies with whom contacts exist, e.g. for development, testing, etc., but who do not buy much or anything).

Customers

Luminar does not have any known customers who purchase larger quantities for their end products. In fact, Luminar has not published any order intake to date.

For MicroVision, the same is true for its Lidar division. In the other business areas, however, MicroVision has already achieved sales in the double-digit million-dollar range, almost exclusively with Tier 1 companies, such as Sony, Sharp, Microsoft:

Source: MicroVision October 2021 and Microsoft

Unlike Luminar, MicroVision is recognized as a supplier by market-leading companies and has already demonstrated the ability to deliver products of the required quality in high volume that are e.g. in use by the US Army through the Microsoft IVAS.

Partners

This refers to companies that have some kind of agreement for something.

Luminar lists many partners who do pay for development systems and services.

MicroVision is run by techies who shun publicity. Luminar, on the other hand, is led by a "sunny boy" and startup CEO Austin Russell.

MicroVision has been in contact with Tier 1 automakers for years (Q2 2021):

Europeans OEMs and Tier 1s in Germany have been the most active in ADAS space, mostly because of regulation, ADAS held to safety and beyond. As we have mentioned before, we have been actively promoting our technology in Germany since 2019.

Tier 1 car manufacturers in Germany are (only):

Volkswagen with the group brands VW, Audi, Porsche, etc.

Mercedes

BMW

This suggests which companies MicroVision might be negotiating with at the moment.

Confidence of the CEO in his own company

The Luminar CEO is currently selling $200 million of his own stock - before the first product is even sold.

This shows the CEO's dwindling confidence in his own company.

Leadership

Not to forget the excellent CEO MicroVision has, who has done an extremely good job in a very short time (two years) and has the qualifications to lead MicroVision to the world market leader in lidar systems and smart glasses. This is where his experience and qualification pays off which the Luminar CEO does not have.

His personal commitment and enthusiasm for success should also be emphasized. While the Luminar CEO only appeared at the IAA in Munich for photo opportunities, the MicroVision CEO was on site every day to meet with customers.

Potential gains in lidar division for MicroVision

Approximately 70 million passenger cars are produced worldwide every year. In addition, there are trucks, etc.

As stated, 2-4 lidar systems are needed for cars, which would correspond to an annual number of about 150-300 million units.

If MicroVision could achieve just 10% share, thus selling 15-30 million units per year, that would equate to $750 million to $1.5 billion in annual profits at just $50 earnings per unit.

At a very conservative P/E of 10, the market cap would then have to be $7.5 billion to $15 billion. That would equate to a share price of about $50-$100.

MicroVision is thus undervalued not only relative to Luminar, but also relative to the expected gutters in the next few years. The author also assumes that MicroVision will achieve a significantly higher market share than only 10%.

The current Luminar stock price of about $15 is equivalent to a MicroVision stock price of $30, since Luminar has issued almost exactly twice as many shares as MicroVision.

Precise forecasts (volumen, profit margin) are difficult. However, it can be assumed that - as with airbags - lidar systems will soon be installed in almost all cars by few suppliers. The market will likely consolidate quickly - because of MicroVision's technical superiority with MicroVision at the top.

Finances

While Microvision only spends about $25 million a year, Luminar requires about $125 million a year. So, five times that.

Luminar (Q2 2021):

Cash, cash equivalents and marketable securities were $580 million as of June 30, 2021, compared to $486 million as of December 31, 2020. Cash spend (operating cash flow less capital expenditures) was $32 million during the second quarter.

The reason is that Microvision can already fall back on fully developed and less complex technology. Microvision (Q2 2021):

second quarter cash used in operations of $6.7 million... Cash and cash equivalents at the end of the second quarter was $135.3 million

Microvision is debt-free.

That leaves Luminar with about $580 million / $125 million = ~4.5 years worth of money. Microvision has money left for about $135 million / $25 million = ~5.4 years.

With the cash reserves it has so far, Microvision can - without revenues - even maintain operations for a year longer than Luminar could (with the same expenses as before).

This puts Microvision in at least as good a financial position as Luminar.

In addition, product sales are about to begin and Microvision also has other businesses that can also achieve high revenues and profits in the coming years.

Conclusion

Conclusion remains: Luminar has no future as a lidar manufacturer due to its already fundamentally outdated and non-performing hardware base. At least not with large car manufacturers. Luminar could only specialize in software.

MicroVision, on the other hand, has the best chance in the market for lidar systems for self-driving cars because of its technically superior hardware base that has been proven in mass-market products such as the Microsoft HoloLens 2.

MicroVision is also very much at an advantage, as mass production will start as early as this year, while Luminar is not scheduled to start until late 2022.

In addition, the excellent, efficient and highly qualified management and development team is certainly superior to Luminar. It has developed the MicroVision Lidar from scratch to production readiness in only two years, while the Luminar team needs two years longer.

Therefore, it is only a matter of (probably short time) that MicroVision receives the first orders from large automotive companies like Volkswagen, Mercedes, BMW etc. This makes short selling of shares very risky.

Orders can come in daily. Also, at some point stock buyers may recognize the massive undervaluation of MicroVision stock in comparison to Luminar and at the same time initiate a short squeeze, which could lead to a price of $60 per MicroVision share. $30 per MicroVision share currently corresponds to the market capitalization of Luminar.

What has also gone completely unnoticed in the discussion is that MicroVision Lidar is probably the only system in the world that is fully immune to light from other lidar systems.

Other manufacturers specify this only for sunlight as discussed before.

However, this is one of the most important features for lidar systems to meet. MicroVision also proved this as the only company at the IAA by having two lidar systems facing each other.

Many cars constantly encounter each other at the same time, on roads, in parking lots, etc. When they dazzle each other, accidents are inevitable. That's why MicroVision is probably the only company, which shows this in a video. The others just can't do it as far as known.

This technological breakthrough, which has so far been completely disregarded in the valuation of the stock, is a very big competitive advantage - along with the others such as resolution, form factor, etc.

That's why here is the link to the MicroVision video again. This technology alone could make an advantage of billions of dollars in profits and make MicroVision the market leader:

Video: MicroVision's Automotive Lidar Sensor: Interference Immunity

Other business areas

Not included in this analysis are the other business areas. While Luminar has no other businesses, MicroVision is the market leader in AR glasses, at least for projectors (see Microsoft HoloLens 2), and also offers solutions for HUD, interactive projectors, consumer lidar. The solution for smart glasses can have a similar success as the one for lidar systems.

Source: MicroVision

Disclosure: I/we have a beneficial long position in the shares of MVIS either through stock ownership, options, or other derivatives.

- Get link

- X

- Other Apps

Comments

Post a Comment