- Get link

- X

- Other Apps

Lidar is road-worthy but won't be making the trip alone

Less autonomy drives lidar vendor consolidation

Gathering all this information accurately is critical, but so is the cost. Camera systems and radar come in under $100 while lidars tend to be in the thousands, which is driving market consolidation. The recent merger of Ouster and Velodyne is a notable example, while lidar sensor maker Quanergy has filed for bankruptcy. Some of the assets of insolvent Ibeo Automotive were recently acquired by MicroVision, a developer of MEMS-based solid-state automotive lidar and ADAS solutions.

“The industry is inching forward on the autonomous vehicle front and not exactly leaping forward as many of us hoped,” said CEO MicroVision Sumit Sharma. “Lidar and autonomous vehicles are no doubt tied together.” Manufacturers on the path to Level 5 autonomy will come to rely on lidar, but right now the automotive market is making the transition from Level 2 to Level 3 autonomy in the coming year. With increased adoption of EVs, he said, car companies are searching for new means of differentiation. “Safety is emerging as the next source of differentiated capabilities, and lidar will play a key role in allowing OEMs to build new safety, proprietary features.”

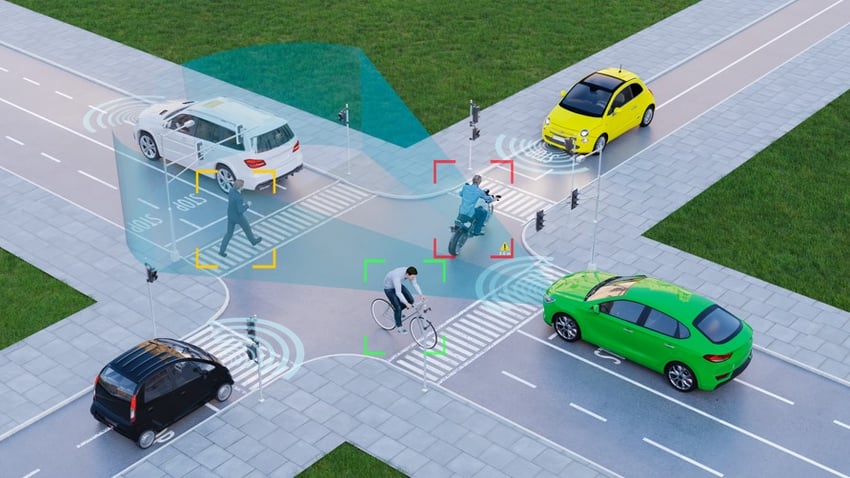

While top-level L5 autonomy does represent huge potential, MicroVision see a multi-billion-dollar market for lidar in helping automakers deliver new safety features in L2, L3 and beyond. But as ready as the company is for L5, Sharma said the debate over which sensing technology is best must be put to rest to truly shift to the kind of innovation needed to elevate from Level 2 to Level 3 autonomy. “Clearing this hurdle will require a solution that incorporates cameras, radar, and lidar--not just one technology,” he said. “Safety is growing as a major differentiator for automotive OEMs and they have the ability now more than ever before to extend safety features more broadly and deeply through their fleets.”

Sharma said every OEM is on its own path towards autonomy with each at different stages and heading towards different end goals. “Our strategy is to be the Tier 1 partner for lidar hardware and perception software with the most OEM-friendly solution and business model.” For MicroVision, that means being flexible to meet OEM’s specific program requirements, he said, right down to the form factor of its sensor, he said. “Our ASIC allows us to build a one-in-box sensor that can be deployed in more places, like roofline mounting.”

Many OEMs are looking to accelerate their ADAS and autonomy programs, Sharma added. MicroVision is building its sensor using materials known to the OEM’s supply chain and incorporating perception software from Ibeo that has already been validated by them, he said, making it easier to get to market faster.

Sharma said there are many opportunities for lidar technology beyond the automotive industry, including commercial vehicle, industrial, robotics and even smart infrastructure production.

- Get link

- X

- Other Apps

Comments

Post a Comment